Distinction Between Cash Foundation And Accrual Basis: Key Comparison

In accrual accounting, the value of long-term belongings is allotted over their helpful lives by way of depreciation or amortization. This aligns expenses with the periods that benefit from the asset, as the value of a capital asset is unfold over its life as it will get used. Money accounting sometimes accounts for the whole asset value at the time of buy. This can severely distort earnings, as an organization might have a huge expense one year followed by little to no expense the next.

Although the cash-basis accounting approach has benefits, there are notable setbacks. For instance, beneath the money basis methodology, retailers would look extraordinarily worthwhile in Q4 as shoppers buy for the vacation season. Nonetheless, they’d look unprofitable within the subsequent year’s Q1 as client spending declines following the holiday rush.

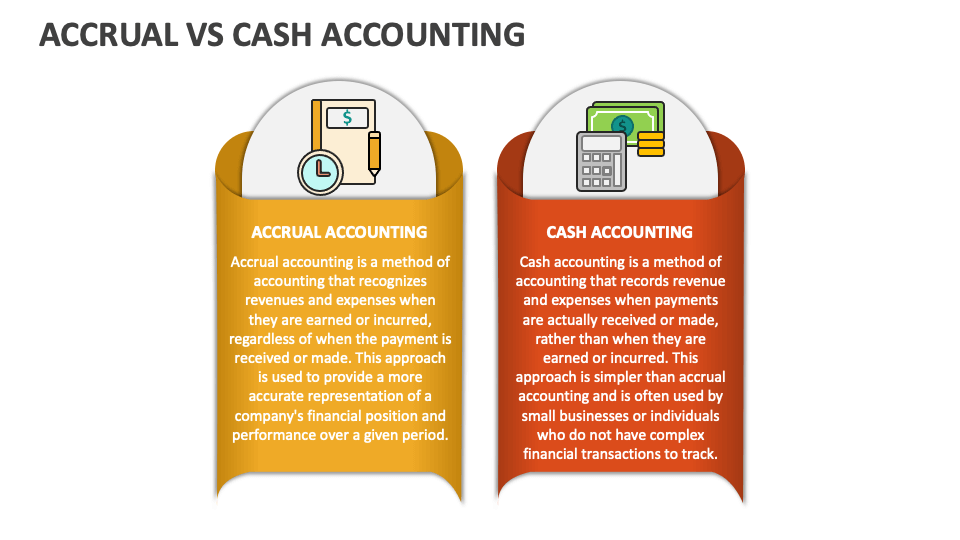

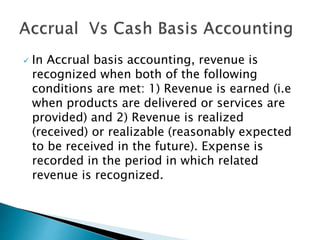

Beneath this approach, earnings is acknowledged when funds are collected, and expenses are acknowledged when they are paid, regardless of when they’re incurred. This methodology is simple and often utilized by small companies and individuals due to its simplicity and ease of monitoring money flow. In Distinction To the accrual basis of accounting, the cash foundation doesn’t adhere to typically accepted accounting rules (GAAP). Cash-based accounting is a simplistic monetary recording system whereby transactions are recorded solely when money modifications arms. Beneath this approach, revenues are acknowledged when cash is obtained and expenses when cash is paid out to outsiders. The key precept of cash accounting, directed to cash flow, has made it considerably intuitive and straightforward for most small enterprise house owners and sole proprietors to manage.

Money basis is a “what you see is what you get” method, the place cash is recorded as quickly because it strikes. Some industries, like development, might use other methods like the share of completion method or the finished contract methodology for accounting. In this article, we’ll explain how one can go about selecting the best cloud accounting software on your accounting firm. First, analyze your small business’s daily operations and financial transactions.

The accrual basis balance sheet paints a comprehensive picture by together with non-cash belongings like receivables and liabilities like payables. This is exactly why it’s the standard required by banks for loans and by serious traders. As you possibly can see, the accrual methodology’s method of matching revenues with the expenses incurred to earn them provides a means more logical and full monetary narrative. Think About your organization indicators a brand new client on December 1st for a $12,000 annual subscription, they usually https://www.simple-accounting.org/ pay the complete amount upfront.

Compliance With Gaap

Bench additionally tracks long-term property on the steadiness sheet, which is typical of the accrual method. As A Outcome Of this method offers you a extra full picture of your business’s finances, it’s more commonly used than the cash methodology. If you document earnings only whenever you get paid and bills solely whenever you pay them, you use the cash methodology.

The Commonly Accepted Accounting Rules (GAAP) requires publicly traded firms to use the accrual methodology of accounting. You must generate monetary statements through the accrual methodology for the IRS to have the flexibility to audit them. The accrual technique can also be necessary for businesses that manage stock.

If a shopper abruptly pays off a big invoice, you could have a lot of cash in your account, making your small business look profitable. But if you have a lot of bills that income has to cowl, you’re not as worthwhile as you appear. For instance, corporations aside from S firms should use accrual foundation accounting in the occasion that they averaged over $30 million in gross receipts over the previous three years. Certain firms and tax shelters — including people who make gross sales on credit score — are additionally prohibited from utilizing money accounting. Accounts receivable and accounts payable are integral to accrual accounting.

What Are The Tax Implications Of Switching Methods?

- This methodical method prevents wild swings in your financial reporting and gives everyone—from your team to your investors—a dependable view of the corporate’s well being.

- As of 2024, small business taxpayers with common annual gross receipts of $30 million or less in the prior three-year interval can use it.

- Nonetheless, this technique could not provide a complete financial picture—especially if you’re managing large receivables or payables, as these aren’t recorded until fee is made or acquired.

- It additionally makes financial reporting extra constant and easier to compare.

- With cash-based accounting, your earnings and bills are acknowledged based on whenever you obtain and make funds.

Being conscious of those strategies is necessary for providing a extra accurate image of financial reporting and successfully managing a enterprise. As a enterprise grows, its finances inevitably get more complicated, and the easy nature of cash accounting begins to feel much less like a feature and extra like a limitation. At this level, switching to the accrual basis is not simply a good idea; it’s often a necessity for sound financial administration and staying compliant. This is where the difference between cash basis and accrual basis really issues for long-term planning. The cash foundation of accounting recognizes revenues when cash is received, and bills when they’re paid. This methodology doesn’t acknowledge accounts receivable or accounts payable.

Hybrid Accounting Methods

Your accounting methodology is the way income (money coming in) and bills (money going out) are tracked and the way each are recorded. Depending on the enterprise model, the accounting methodology can clarify your business’ monetary picture. Every taxpayer must use a consistent foundation of accounting to report revenue and bills. Yes, companies can use a combination of both strategies, known as the modified money foundation.