What Is Black Friday?

But Black Friday subsequently came to have one other that means in the 1980s. In current years, we’ve been seeing what has been known as the “Black Friday creep.” Many retailers are beginning What Is Black Friday their Black Friday gross sales online and in-store several days (or even weeks) earlier than Thanksgiving. Others are dividing their Black Friday sales into a sequence of savings occasions all through November.

As we answer the query, “What is Black Friday?” it is useful to have a look at some figures. While many individuals imagine the time period Black Friday finds its roots within the sense of black meaning “showing a profit; not displaying any losses,” this isn’t actually the case.

In order to create pleasure round this essential day, main retailers and the media looked for a approach to promote the day after Thanksgiving. The time period Massive Friday was used early in the 1980s, however it did not catch on. The name Black Friday got here next, most likely in reference to the frenzied crowds and terrible traffic usually found around malls on that day. This led to intense competitors amongst newer retailers to draw shoppers—along with a willingness to interrupt with trade conference to gain an edge. The real history of Black Friday dates again to Nineteen Sixties Philadelphia, where a giant Army-Navy football game held every year on the Saturday after Thanksgiving attracted giant crowds to town and its stores. Police needed to work additional onerous on Friday to deal with the chaos and couldn’t take the day off, so that they coined the time period Black Friday.

Retailers determined to create a brand new story for Black Friday to shift away from the adverse association with the black days of the week. This yr, they are saying analysis means that “shoppers are prepared to make huge purchases forward of Christmas and Black Friday.” From “How many federal holidays are there?” to “What’s the healthiest Thanksgiving facet dish?” to What is November’s birthstone? ” – we’re striving to find solutions to the commonest questions you ask every day. Head to our Simply Curious section to see what else we will answer. Spreading out the sales didn’t harm spending throughout Cyber Week, as the spending quantity was up 8.2% year over 12 months for a complete of $41.1 billion.

Additionally, Walmart’s CEO said that maintaining shops open on Thanksgiving is “a factor of the past.” Beneath, we have listed a few of our high deal guides that can assist you discover every thing you are after. The content material on this website is for leisure purposes only and CBS Sports Activities makes no illustration or warranty as to the accuracy of the knowledge given or the end result of any recreation or occasion.

- They predict all vacation spending will be up 6% to 8% over final 12 months, an early signal that the day after Thanksgiving could have a big financial impression.

- Even with many places easing their pandemic restrictions this year, Black Friday is probably going by no means going to be the identical because it was earlier than.

- We don’t know what Stanley may have on sale for Black Friday 2025, but we’re fairly confident there shall be Quencher tumbler offers.

- Issues obtained off to a rocky start on Friday, nonetheless, as the Europeans dominated the morning session of alternate shot.

Adobe Analytics reported that nationwide Cyber Monday gross sales rose eight.4% annually to reach https://tax-tips.org/ $11.6 billion in 2022. If you like finding great offers, Black Friday is the day you won’t need to miss. Celebrated yearly on the Friday after Thanksgiving within the Usa, Black Friday kicks off the vacation purchasing season with unbelievable discounts and exciting offers.

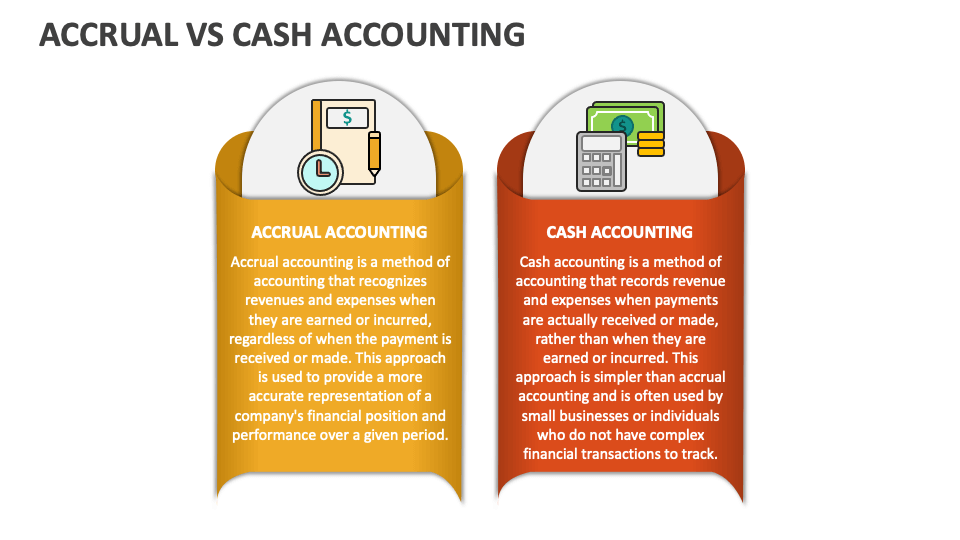

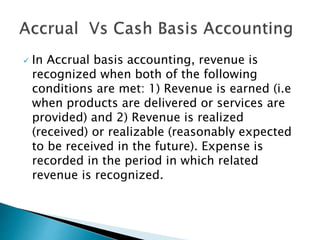

Many retailers would discover themselves “within the purple” by fall but would be boosted back “into the black” by the holiday shopping season. It is now most popularly used in the US to discuss with the day after Thanksgiving, which is usually thought of the primary day of the vacation shopping season and is known for that includes reductions from retailers. Black Friday prices are sometimes among the many lowest of the yr, but they’re not all the time the absolute lowest for every merchandise.

Many stores supply highly promoted gross sales at closely discounted prices and infrequently open early, typically as early as midnight2 and even on Thanksgiving. Some stores’ sales continue to Monday (“Cyber Monday”) or for a week (“Cyber Week”). Having a worthwhile Black Friday is essential for many retailers, especially toy and sport stores. From 2017 to 2021, the vacation season amounted to about 19% of annual gross sales for so much of retailers, according to the NRF.